Calculate accumulated depreciation

LoginAsk is here to help you access Calculate Accumulated. To calculate accumulated depreciation simply add up the yearly depreciation amounts for the asset up to that point.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Its important to determine.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

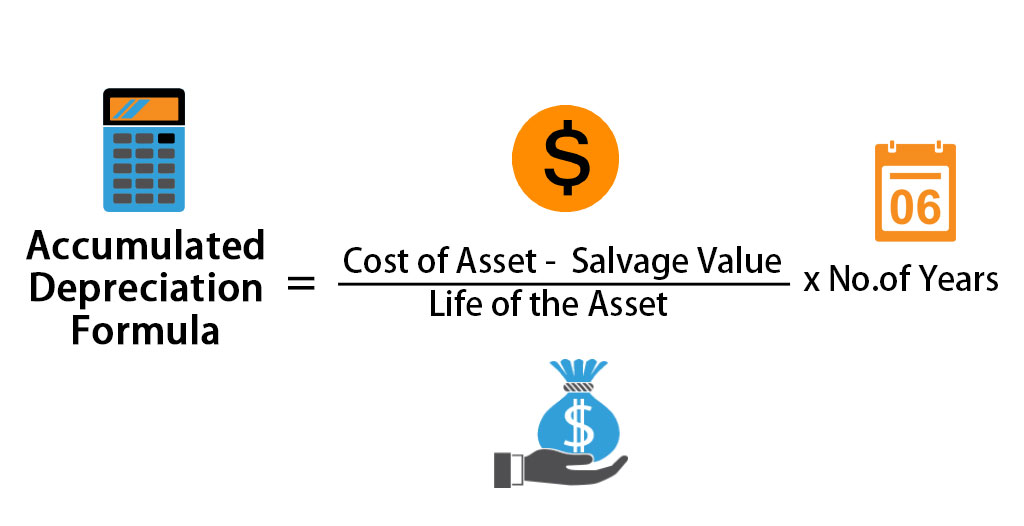

. Let us take the same example of how to calculate accumulated depreciation that we used in the straight-line method. Calculate the sum of years digits by adding them together. Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

The straight line calculation steps are. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. If the building cost 400000 and the salvage value is.

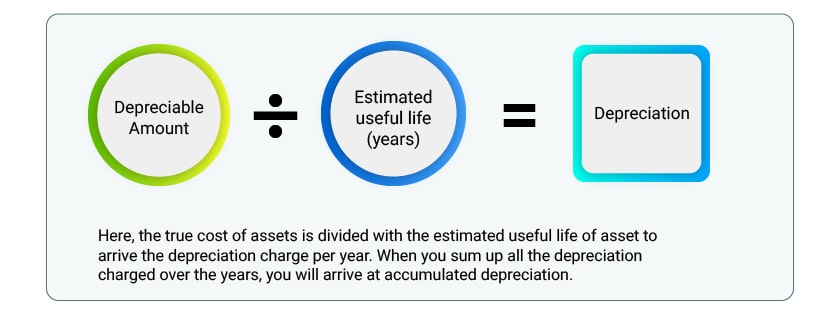

You can calculate subsequent years in the same way with. Determine the cost of the asset. Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at.

So in the second year your monthly depreciation falls to 30. Calculate Accumulated Depreciation Calculator will sometimes glitch and take you a long time to try different solutions. The calculator allows you to.

Use the following guide to calculate accumulated depreciation with the straight-line formula. It is the cost of the building minus the salvage value. How to Calculate Accumulated Depreciation.

Fixed cost method also known as cost price or straight-line method. Subtract the estimated salvage value of the asset from. The asset cost is 1500 and its usable life is 6 years.

How do you calculate accumulated depreciation on a building. How to Calculate Straight Line Depreciation. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

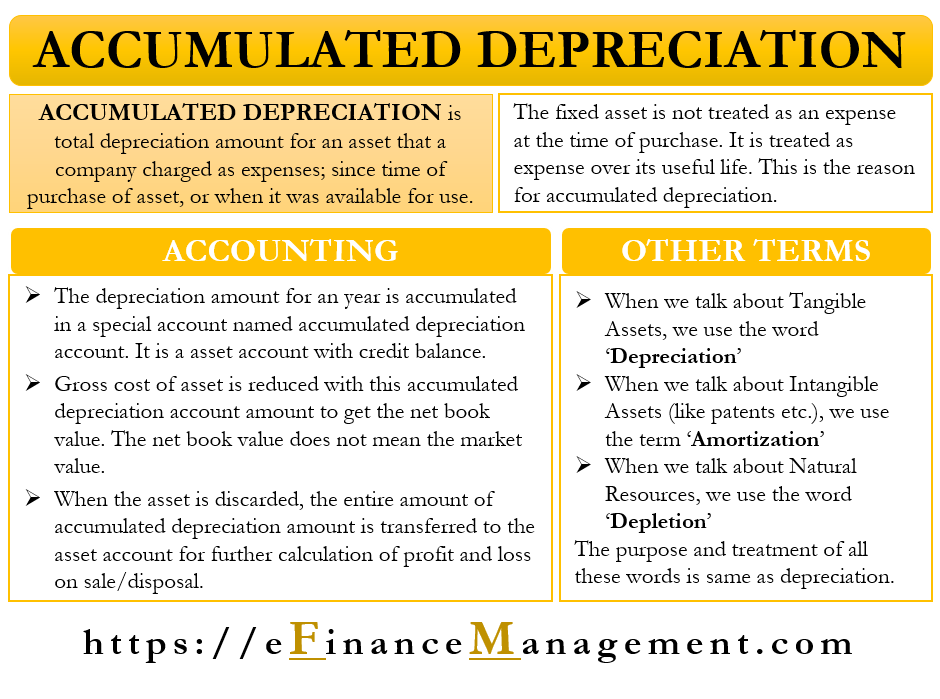

Depreciation represents the allocation of the. How to Calculate Accumulated Depreciation. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

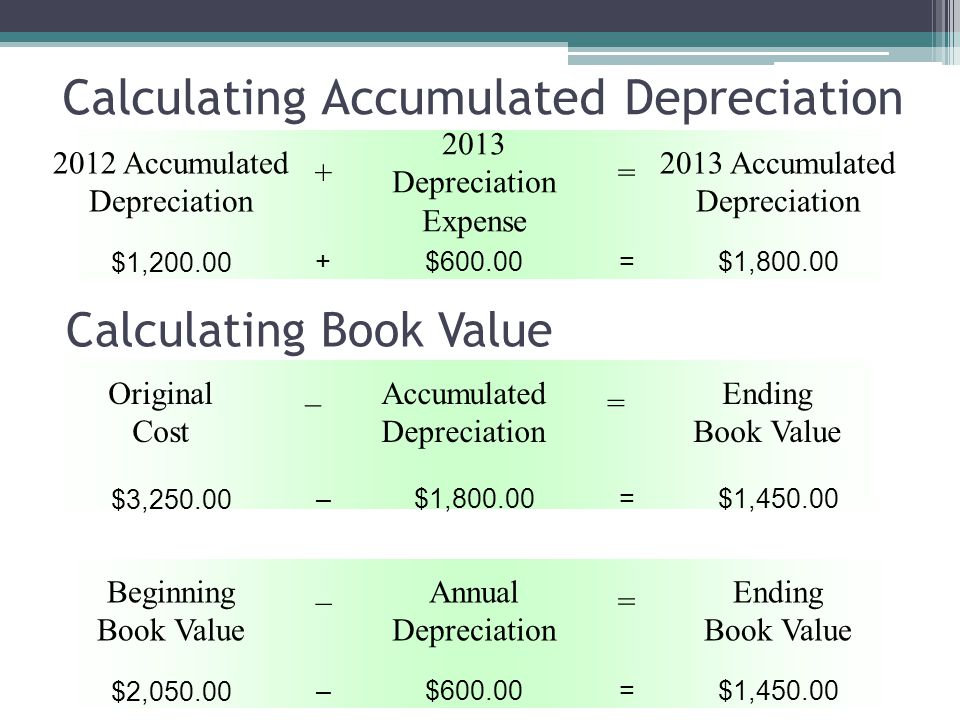

This implies that depreciation expense per year is 2000 for Harry Co. Second year depreciation 2 x 15 x 900 360. Subtract salvage value from the original cost.

Accumulated depreciation is a line item in a companys financial statement that represents the decline in the value of an asset that a company owns. Now let us look at the two different methods and how we calculate accumulated depreciation in each. Depreciation Charge 20000 10 2000.

Depreciation represents the allocation of the purchase of a fixed asset or capital expenditure over its useful life. Knowing the salvage value of the. For example imagine an asset that has been in use for.

Subtract salvage value from the original cost. To calculate accumulated depreciation using the sum of years depreciation method follow the steps below. 31 st December 2010 the carrying value of the.

The simplest way to. For instance a widget-making machine is said to depreciate. Here are the steps for how to calculate accumulated depreciation using the primary method.

In our example lets use our existing cost basis of 206000 and divide by. An assets carrying value on the balance sheet is the difference between. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

At the end of 2010 ie. How to Calculate Accumulated Depreciation. First one can choose the straight line method of.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Use the following steps to calculate monthly straight-line depreciation.

Accumulated Depreciation Calculator Download Free Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Methods Principlesofaccounting Com

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition How It Works Calculation Tally

Accumulated Depreciation Accountingtools India Dictionary

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Accountingtools India Dictionary

Accumulated Depreciation Overview How It Works Example

On Arrays And Accumulated Depreciation Tvmcalcs Com

Accumulated Depreciation Meaning Accounting And More

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Explained Bench Accounting

Depreciation Expense Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation